Record purchases of central banks. They haven't bought so much gold since 1967

31. 01. 2023Last year, central banks reported the largest gold purchases in 55 years. They love it and have been buying it consistently since 2010. Gold acts as a safeguard against the effects of an uncertain geopolitical situation and, more recently, extremely high global inflation.

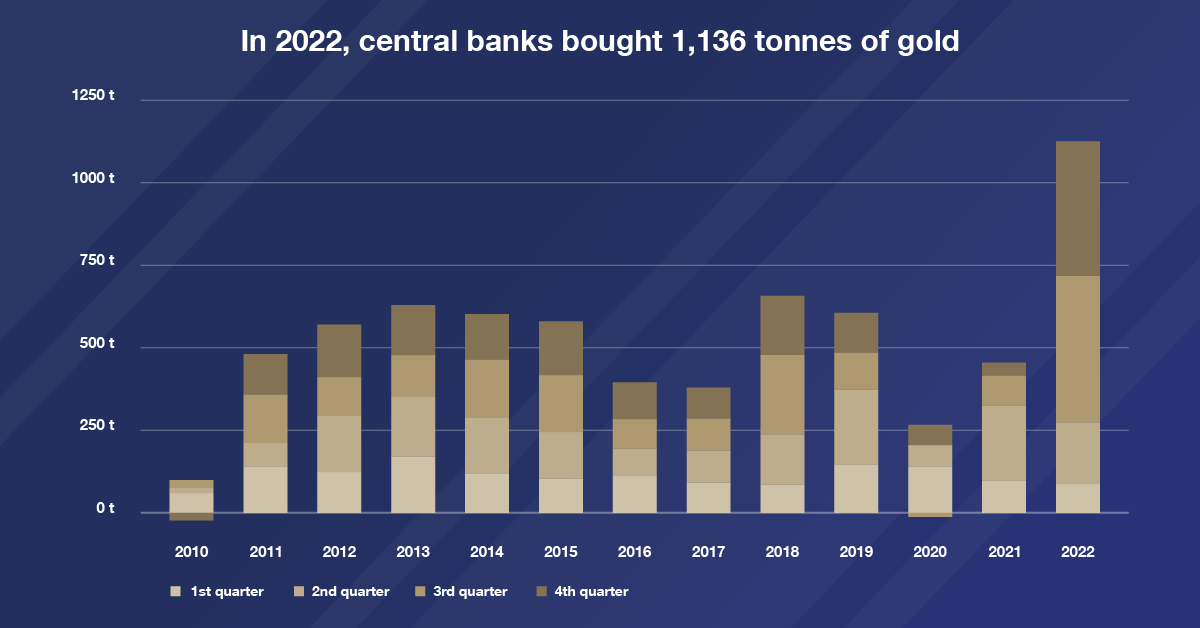

National banks have been strengthening their gold reserves for thirteen consecutive years. However, the pace of purchases increased unprecedentedly last year, particularly in the second half of the year, when national banks bought over 862 tonnes of the precious metal. They increased their reserves by record‑breaking 1,136 tonnes of gold during the year.

Net purchases in the last quarter reached 417 tonnes of gold. Banks from emerging markets such as Turkey and China were the main buyers. The People's Bank of China, which still held about 1,448 tonnes of the precious metal in 2019, announced gold purchases of 62 tonnes at the end of last year. Its gold exceeded 2,000 tonnes, an increase of almost 40%. However, the largest purchase in 2022 was announced by the Central Bank of the Republic of Turkey. Turkey's official gold reserves rose by 148 tonnes hitting a record high of 542 tonnes. The Czech Republic also belonged among the gold buyers in 2022, increasing the volume of gold in its reserves by 1 tonne.

It is clear that considerable geopolitical uncertainty and hard‑to‑control inflation had an impact on the market last year. As a result, many central banks quickly revised their reserve strategies. Gold probably won out with them because of its ability to preserve value over the long term and because of its performance in times of crisis. The factors that influenced developments in 2022 persist and are more likely to gain strength in 2023. We therefore assume that interest in gold will continue.