The price of gold rose last year – what does it mean for mining, and will there be enough of the metal?

09. 04. 2025There’s no doubt that gold has seen a surge in demand. Central banks have made record purchases for a third consecutive year, and investors are turning to it as a safe haven for long-term security. But how does the supply side measure up? What challenges are mining companies facing, and how are their rising costs linked to the price of gold?

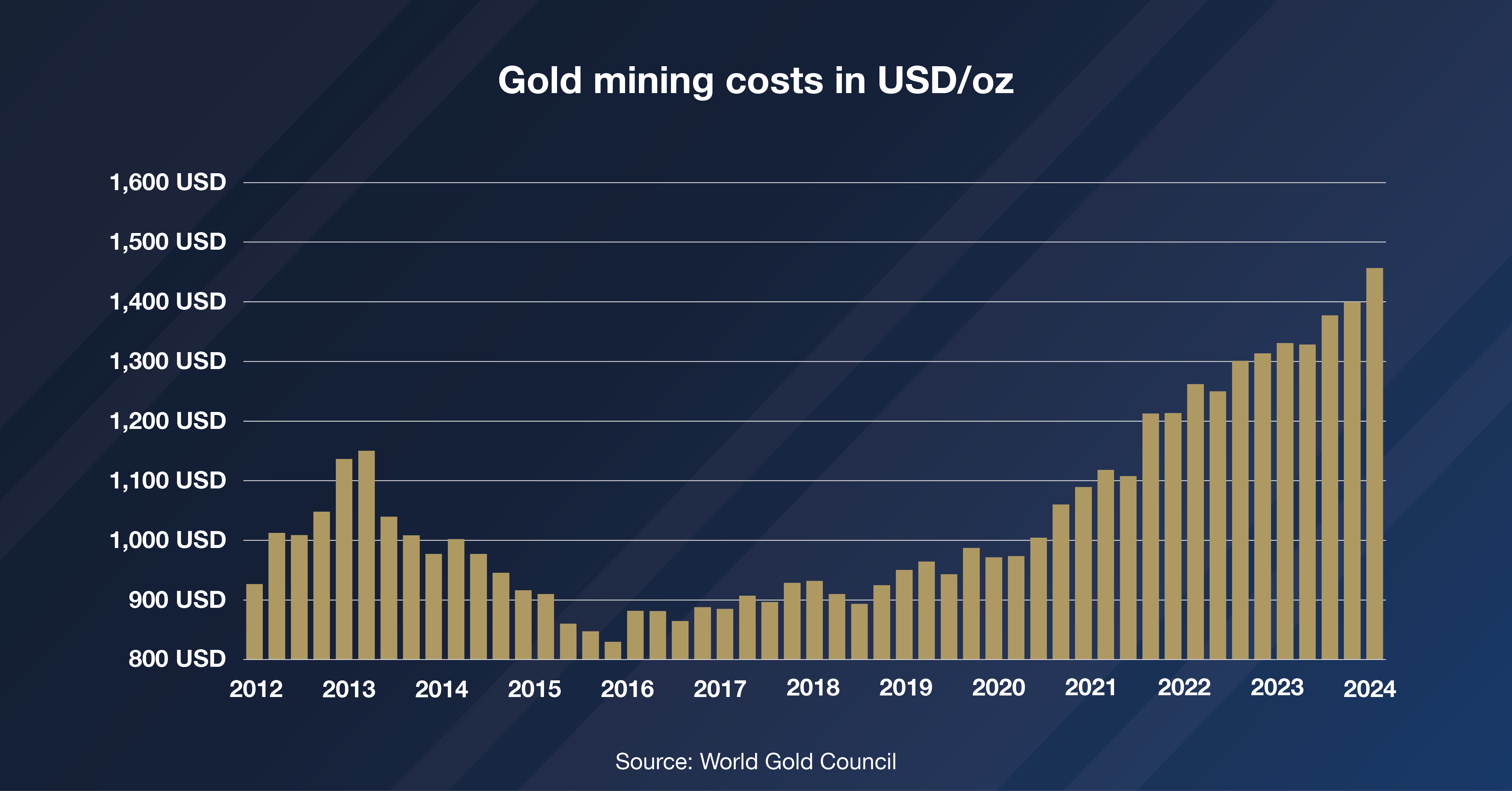

The soaring value of gold continues to underscore its strength and attractiveness among investors. By the end of the third quarter of 2024, gold prices had stabilised above the $2,600 mark. However, average all-in sustaining costs (AISC) – covering all direct mining expenses, including labour, materials, energy, taxes, and licence fees – also rose, pushed higher by reduced output, increased licence fee payments, and a rise in sustaining capital expenditures.

In the third quarter of 2024, global average licensing and tax costs rose to $90 per ounce, up 5% from the previous quarter and a 31% increase year on year. Sustaining capex also went up, climbing to $303 per ounce. While this represents only a modest quarter-on-quarter increase of around 3%, it results in a 50% rise overall. AISC currently averages $1,456 per troy ounce, the highest in the World Gold Council’s data series (since Q1 2010).

How are rising costs and gold prices linked?

The rising price of gold and increasing AISC often go hand in hand. This is because, as gold prices climb, even lower-grade ore becomes economically viable to mine, making it easier to offset the higher costs associated with more complex extraction processes. On the other hand, licence fees, taxes, and sustaining capex are also on the rise.

However, the increase in sustaining capex also reflects investment in upgrades and in the development of new projects by mining companies as their revenues and profits expand.

Costs are rising everywhere, but at different rates.

In Africa, AISC reached $1,532 per troy ounce, up 4% quarter on quarter and 14% year on year. These increases were largely driven by reduced output (e.g. in Ghana) and by operational challenges related to suspensions in Mali.

In Oceania, AISC climbed to $1,464 per ounce, driven primarily by higher sustaining capex and a decline in output at certain sites, such as Papua New Guinea and Australia.

A similar trend was observed in South America, where the World Gold Council reported an increase in AISC to $1,197 per ounce. Adverse climate conditions and ongoing project work were behind this rise.

In North America, specifically Canada and the United States, mining costs held steady at $1,508 per troy ounce, reflecting only a minimal 2% year-on-year increase. While some Canadian mines reported record yields, the US in particular faced higher costs due to lower-grade ore.

Overall, despite rising costs, 97% of primary gold production remains profitable. Mixed regional results and growing AISC suggest that the mining sector is entering a new phase, where rising costs are offset by near-record gold prices. These trends present both challenges and new opportunities for gold producers, who must adapt to the dynamically evolving market conditions.