Gold Overtakes the Euro to Become the World’s Second Largest Reserve Asset

20. 06. 2025Bc. Miroslava Sojkova, Social Media Director

Gold – a symbol of security, permanence, and value – has chalked up another major success. Latest figures from the European Central Bank indicate that it is now the world’s second-largest reserve asset, ahead of the euro itself.

A change with global implications

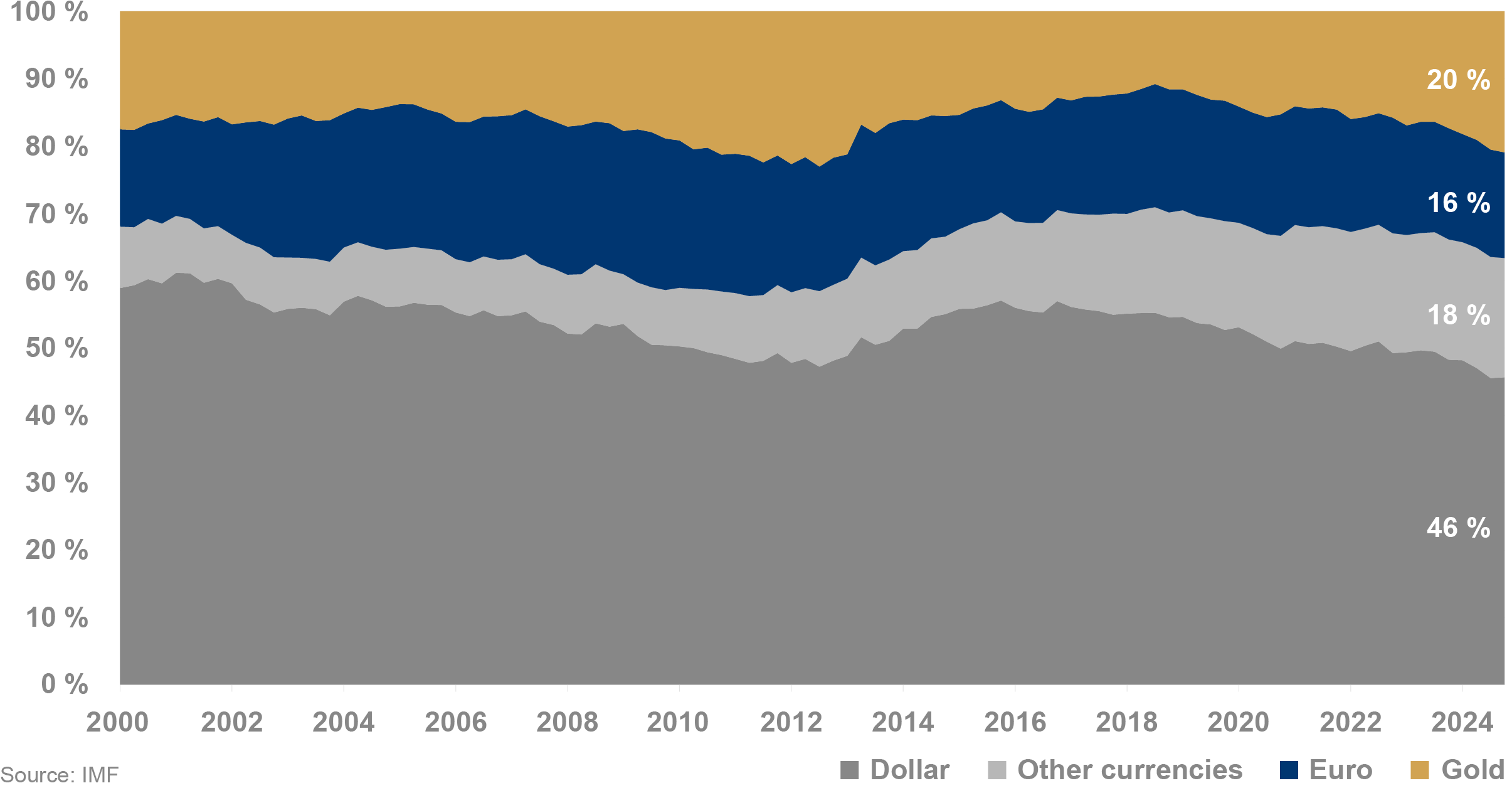

Gold now accounts for 20% of official foreign exchange reserves held by central banks, while the euro’s share has fallen to 16%. The US dollar remains in first place, with a share of approximately 46%, but the shift we have just witnessed could signal a long-term change in confidence in global currencies.

“In 2024, gold made up approximately 20% of official global reserves, while the euro dropped to 16%.” (Source: ECB)

Composition of official global reserves

Why gold?

Gold’s dominance is no accident. The events of recent years – from geopolitical turmoil to economic uncertainty and structural shifts – have set the stage for gold to shine.

1. Certainty in uncertainty

At a time of sanctions, armed conflict, and heightened global tensions, central banks (especially outside the West) are turning to assets that are not tied to any one country or policy. Gold is ideally suited to this role: it is anonymous, independent, and universally accepted.

“For many central banks, gold acts as a hedge against geopolitical risks and the freezing of financial assets,” notes the ECB, based on its survey of central banks.

2. Lower risk, greater certainty

Unlike currencies, whose value depends on confidence in a particular government or central bank, gold has no “counterparty”. Its value stands on its own, and it has consistently proven to be a reliable store of wealth throughout history.

3. Soaring prices

The price of gold rose by more than 30% in 2024, with this positive trend continuing into the first quarter of 2025. This not only increased the value of existing central bank reserves, but further strengthened gold’s importance in their portfolios.

The numbers speak for themselves

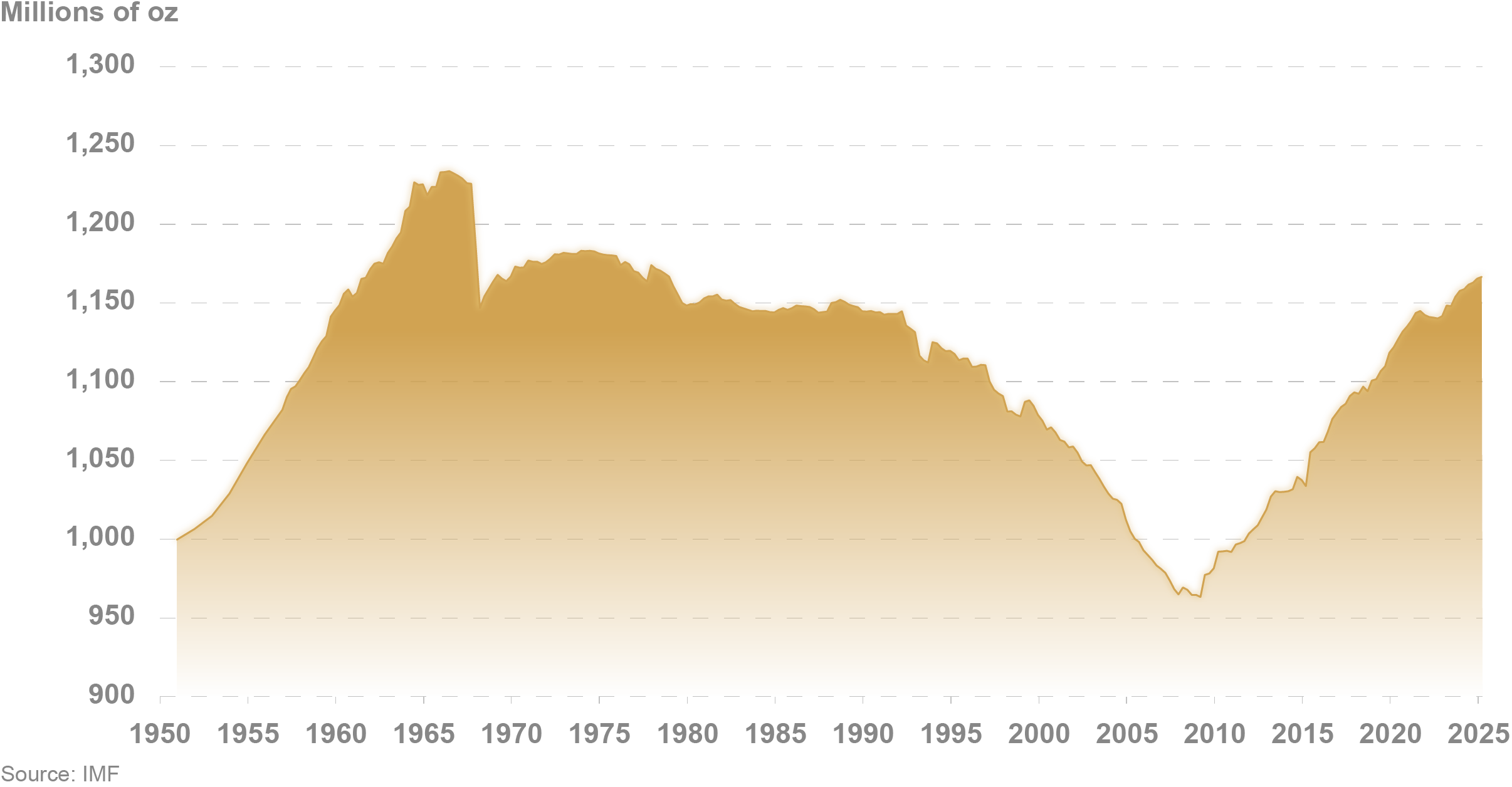

- 36,000 tonnes of gold held in official reserves – the highest level since the end of the Bretton Woods system

- Over 1,000 tonnes of gold purchased by central banks in 2024 alone – a third consecutive record-breaking year

- The euro has dropped below 17% in global reserves

- Gold now accounts for 20% of total official reserves – in other words, one in five “dollars” in global reserves is backed by gold

“Central banks continued to accumulate gold at a record pace, acquiring more than 1,000 tonnes in 2024,” confirms the Financial Times, highlighting the growing interest and long-term trend.

World gold reserves

What does this mean for us?

This development is a powerful signal to everyday investors, financial strategists, and governments alike. It shows that tangible, trusted stores of value are back in vogue. At a time when fiat currencies face mounting challenges, gold is once again being seen as a strategic pillar of financial stability.

And as the saying goes, those who sow today, will reap a rich harvest tomorrow.