Record Highs Not Enough: Central Banks Keep Buying Above-Average Amounts of Gold

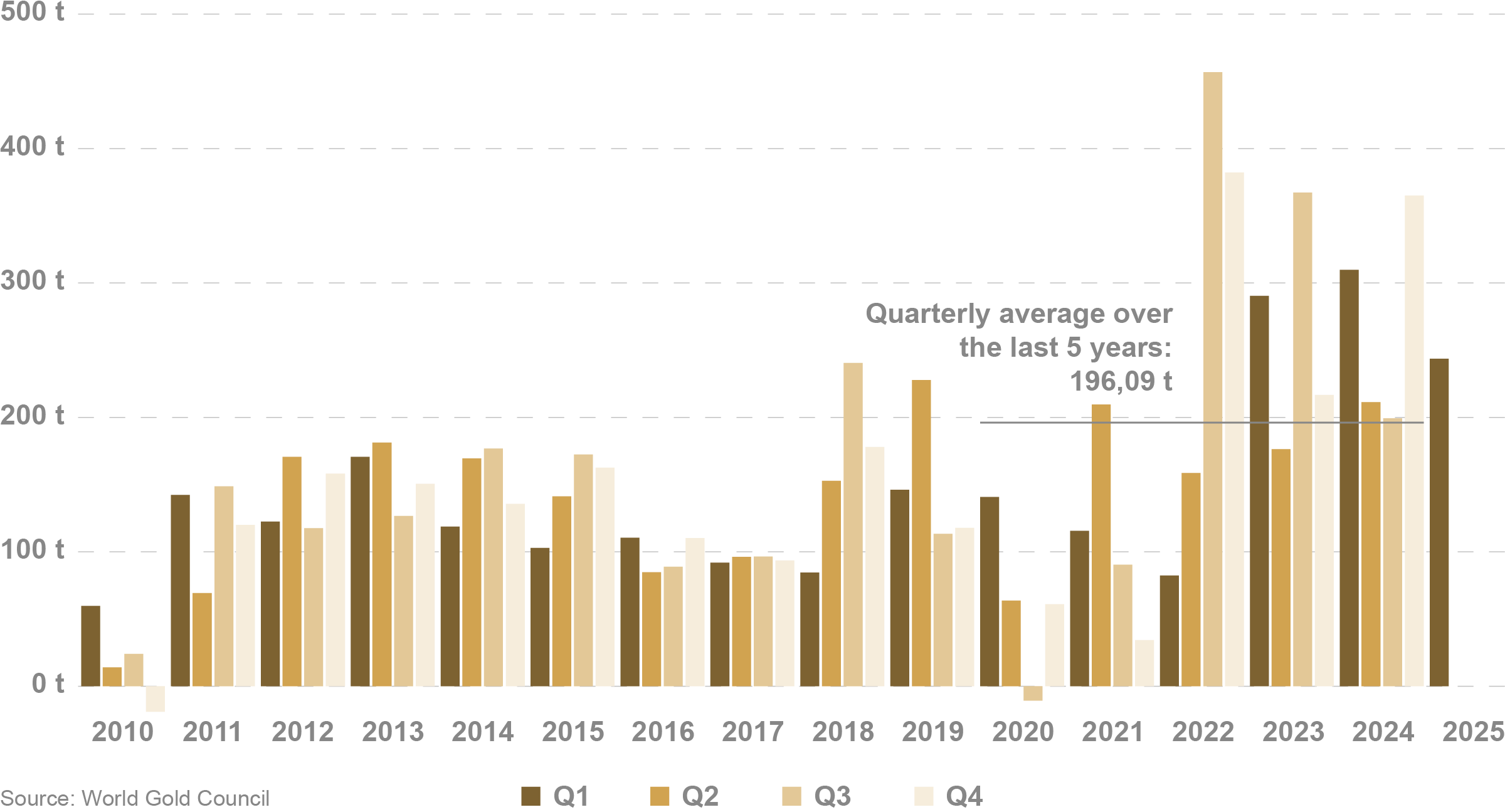

22. 05. 2025Banks haven’t stopped buying gold—even after last year’s record purchases. On the contrary, in the first quarter of this year alone they added another 244 tonnes of the precious metal to their official reserves. This comes from the regular quarterly report of the World Gold Council. So how did the first three months of 2025 look from the perspective of central banks?

Although demand from the world’s major institutions for gold didn’t reach the level of Q4 2024, it remains exceptionally strong. It is still 24 % above the five-year quarterly average.

Volume of Gold Purchases by Central Banks (t)

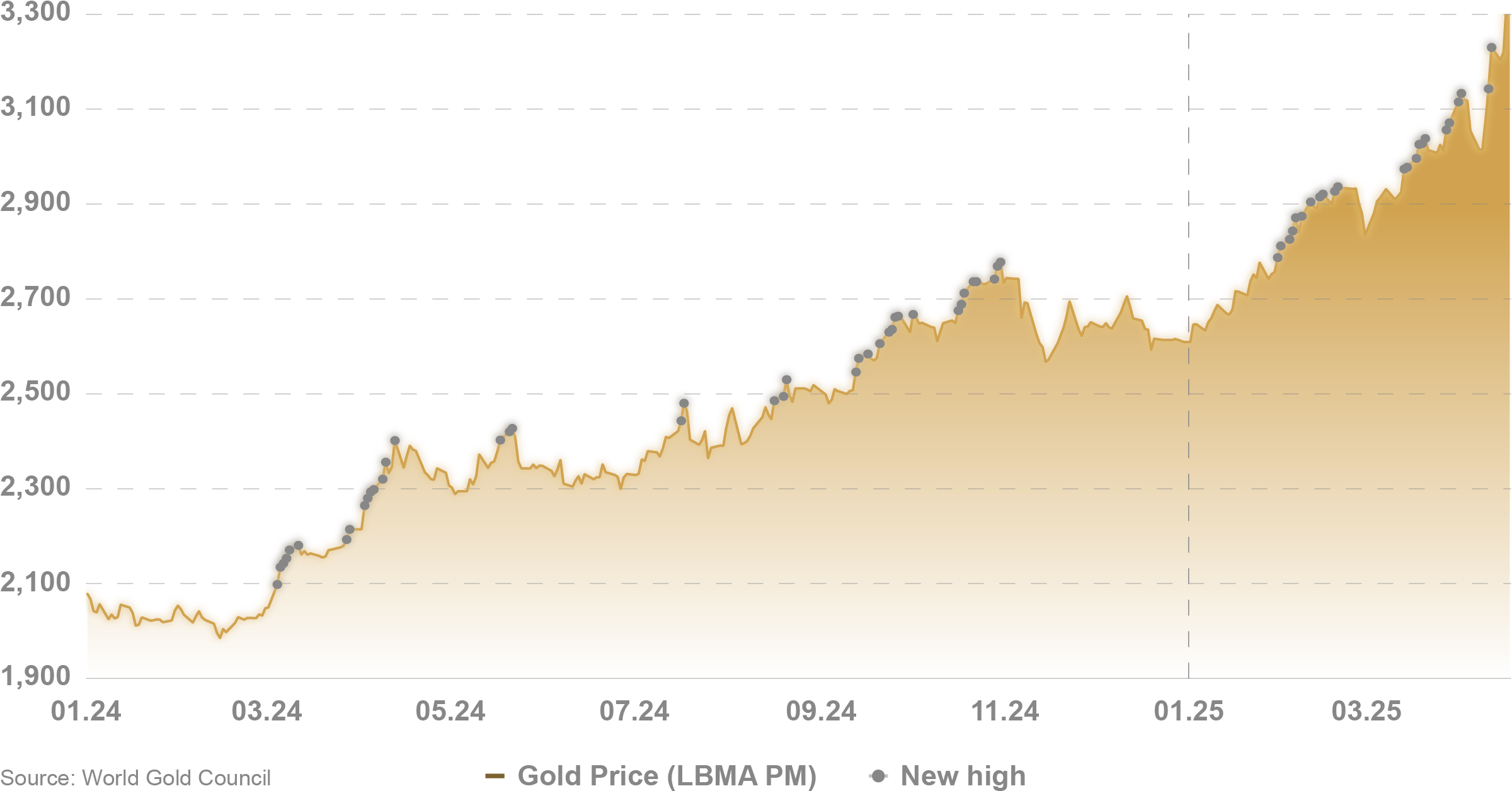

In simple terms, central banks still regard gold as an important strategic asset. The uncertainty—primarily the threat of U.S. tariffs, the geopolitical situation, stock-market volatility, and a weak U.S. dollar—which helped the price of the precious metal climb to 20 new record highs during the quarter, is likely also driving central banks’ growing interest in increasing their gold reserves.

Gold price trend (USD/oz)

A 2024 survey by the World Gold Council shows that central banks value gold most for its ability to preserve value and perform well during crises. The turbulent developments in the first quarter have once again confirmed these advantages of gold.

Who Bought the Most?

Poland has been among the most significant buyers for some time. Its central bank shows no signs of slowing down—in fact, it is accelerating its purchases, adding another 49 tonnes of gold to its vaults, which represents 54 % of its total gold demand from last year. Currently, the National Bank of Poland holds 497 tonnes of the precious metal, accounting for 21 % of its total reserves.

China, another key player, announced it increased its gold reserves by 13 tonnes in the first quarter, bringing the total to 2,292 tonnes, which corresponds to 6.5 % of its overall reserves. The National Bank of Kazakhstan increased its official gold reserves by 6 tonnes. It currently holds 291 tonnes, and according to statements by the bank’s deputy governor to Bloomberg, the national bank will suspend gold sales until uncertainty decreases and prices stabilize. The Reserve Bank of India added 3 tonnes, bringing its total gold reserves to 880 tonnes, or 12 % of its overall reserves.

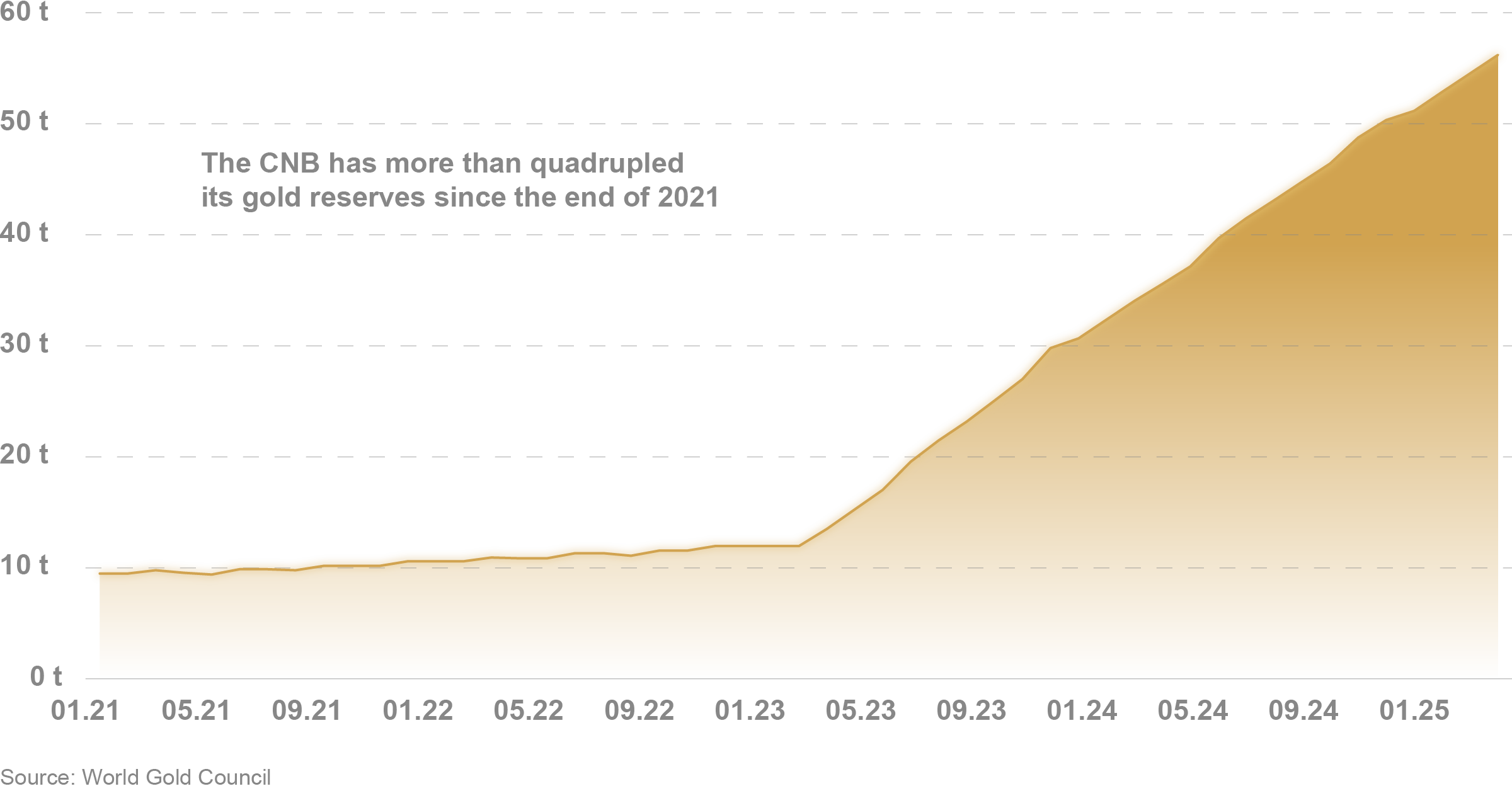

The Czech National Bank purchased 5 tonnes of gold during the first quarter. Its strategy is systematic accumulation of the precious metal. Thanks to this approach, the bank has more than quadrupled its gold reserves since 2021. It currently holds 56 tonnes of gold reserves.

Governor Aleš Michl has previously stated that the bank relies on regular purchases, taking advantage of dollar-cost averaging. “We regularly buy a certain amount every quarter; we do not try to time the market. I would recommend the same to investors—to invest regularly, gradually, without speculation.”

The central bank began buying gold in larger quantities in 2022. By the end of that year, it held about 12 tonnes in reserves; in 2023, the volume of gold reserves rose to 30.7 tonnes, and by the end of last year, it reached 51.2 tonnes. Governor Michl aims to increase Czech gold reserves to 100 tonnes within three years through this strategy.

Czech National Bank Gold Reserves Development

The Numbers Are Likely Even Higher

The World Gold Council points out that historically, reported purchases accounted for only 22 % of central banks’ actual demand. This confirms that interest in the precious metal is truly significant—beyond what the IMF’s IFS data, which the report is based on, actually shows. The company explains this, for example, by delays in reporting and purchases made by official institutions that are not central banks.

The trend of central bank gold buying entered its sixteenth year in the first quarter of 2025, and it is expected that the increased level of uncertainty will continue to support gold’s role as an attractive reserve asset.

Major global banks (JP Morgan, Goldman Sachs, and Saxo Bank) even revised their gold price forecasts last month after gold surpassed their full-year estimates within just four months.(We wrote in the article: Gold exceeds expectations. Analysts predict that its appreciation will reach more than 50% in 2025). What does this mean? It is likely that gold will no longer be cheaper. By making regular purchases you can gradually build a strong and effective shield against inflation, global instability, and crises.