Gold defies expectations. Analysts predict returns of over 50% in 2025

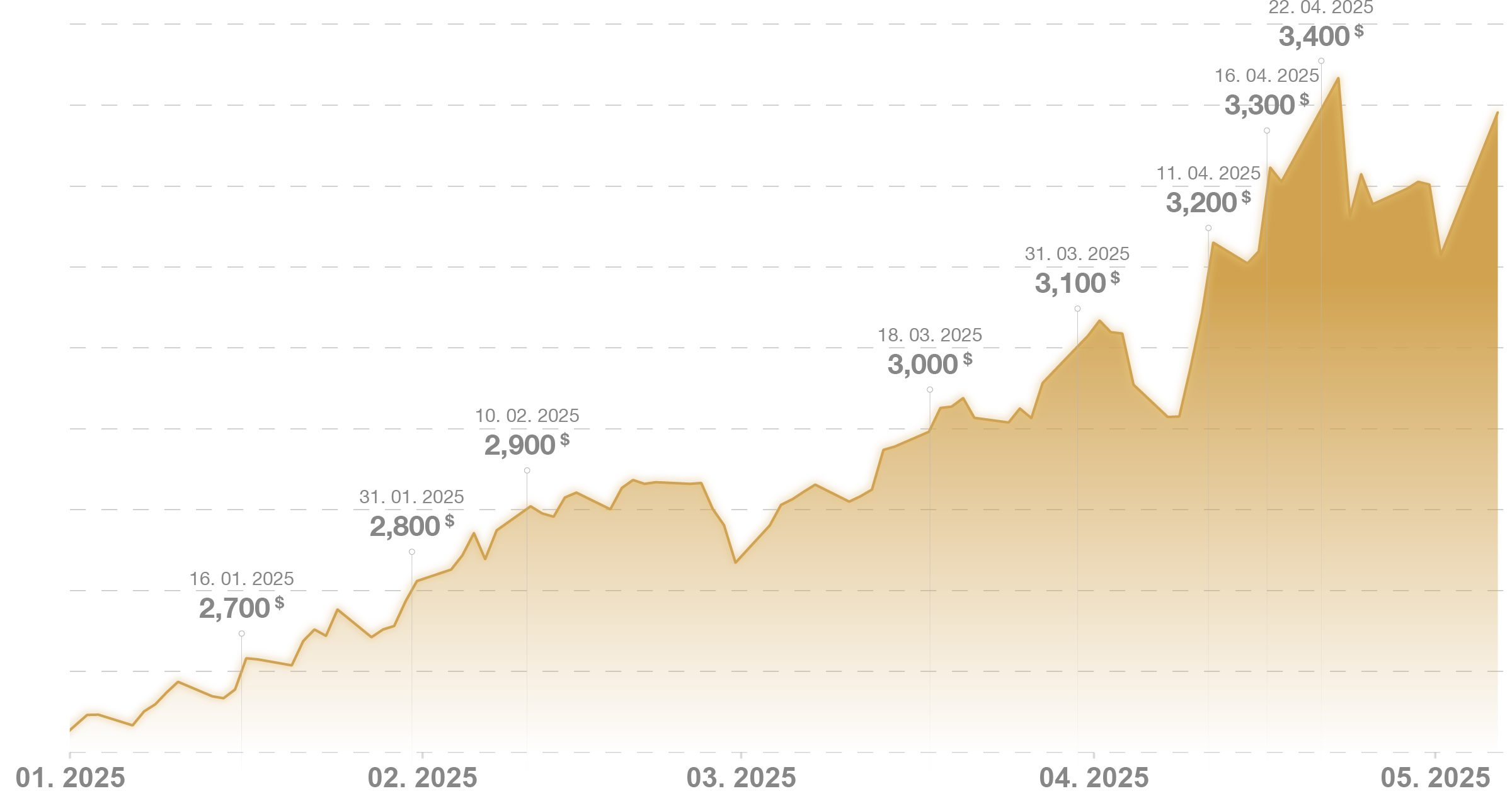

09. 05. 2025Gold is taking even the most seasoned investors’ breath away this year. In just four months, its value has surged by over 30%, outstripping every forecast and analyst prediction for 2025.

For centuries, gold has stood firm as a trusted refuge in times of uncertainty. Now, its dramatic ascent is once again proving it to be a rock-solid pillar for safeguarding wealth. Rising demand from investors and experts alike underscores the one simple truth that, in times of economic turbulence, inflation and geopolitical shocks, gold remains a safe way to preserve and grow wealth.

From a starting price of USD 2,650 per troy ounce in January, gold climbed 13% to USD 3,000 by March. April brought an even steeper rally, hitting USD 3,300 before soaring further to nearly USD 3,500 in the same month. That marks a 30% rise so far, prompting the natural question: where will gold go from here?

Experts dramatically revise their outlook

Currently trading at around USD 3,400, gold is prompting major global banks to reassess their forecasts. Saxo Bank, for example, has already raised its outlook from USD 3,300 to USD 3,500 per troy ounce, yet gold is fast approaching even this new figure, suggesting another revision may be on the horizon.

Meanwhile, JP Morgan expects gold to break through USD 4,000 per troy ounce next year. By the end of this year’s fourth quarter, the banking giant forecasts an average price of USD 3,675, before rising above the USD 4,000 mark in the second quarter of 2026. Prices are being driven higher by mounting fears of a recession triggered by increased US tariffs and the ongoing trade war between the US and China.

Goldman Sachs also weighed in this April, raising their projection from USD 3,300 to USD 3,700 per troy ounce. In a more extreme scenario, they suggest gold could reach as high as USD 4,500 by the end of 2025.

Gold price forecasts for 2025

Four key forces fuelling gold’s rise

The prospect of a global recession on the back of US tariffs and trade wars is far from the only engine propelling gold upwards. Saxo Bank’s chief commodity strategist Ole Hansen has reported that four other factors are at play in the meteoric rise of gold prices.

US Fed interest rate expectations: Markets are currently pricing in a cut of 75–100 basis points. Lower interest rates reduce the opportunity cost of holding gold, making the metal more attractive to investors seeking alternatives to traditional yields.

Rising inflation expectations in the US: When the spectre of inflation looms, investors often seek refuge in gold because, as real returns on fixed-income assets dwindle, the relative appeal of gold grows.

Geopolitical tensions: Global instability tends to steer investors towards safer assets. The recent correlation between defence stocks and gold suggests that rising geopolitical anxiety (whether from conflict, war or diplomatic strife) means investors are looking to gold for safety.

Central bank demand: More and more central banks are diversifying away from the US dollar and turning to gold as a neutral reserve asset. In each of the three years to 2024, central banks purchased over 1,000 tonnes of gold, and this trend is expected to continue in 2025.

Is now the right time to buy gold?

The answer depends on your financial goals, risk appetite, and desire to shield your savings from today’s uncertainties. Looking at the long-term trend, on the balance of probabilities it is unlikely that gold will become significantly cheaper.

History clearly shows that gold maintains steady growth and often rises sharply during times of market disruption or instability. While short-term fluctuations in price may occur, the chances of a significant drop under current conditions are slim.

You don’t have to invest all at once. A strategy of regular purchases allows you to average your buying price, so you invest advantageously regardless of the current market price. What matters most is making the actual decision to get started on building your gold reserve. You can always top it up with one-off contributions, especially during price corrections. iiplan® saving schemes offer maximum flexibility, letting you adjust, increase, or pause your investment as needed. iiplanGold®, iiplanRentier®, and iiplanMax® are modern products that even allow you to have funds paid out to you or use your gold balance for transactions. That gives you the freedom to optimise your gold reserves in line with your needs and investment plans.

As at 28 February 2025, IBIS InGold’s iiplan® customers had earned a total profit of CZK 6,439,454,138 (nearly CZK 6.5 billion – EUR 260 million!).

So don’t wait for the elusive “perfect moment” that may never come. What matters more is starting as soon as you can and steadily expanding your gold reserve. Regular investment reduces the risk of bad timing and lets you benefit from the long-term rise in gold prices. The flexibility of iiplan® schemes puts you in complete control of your gold investments. Unlock gold’s full potential by choosing to invest. This is a decision that could mark the beginning of a new chapter in your financial security.