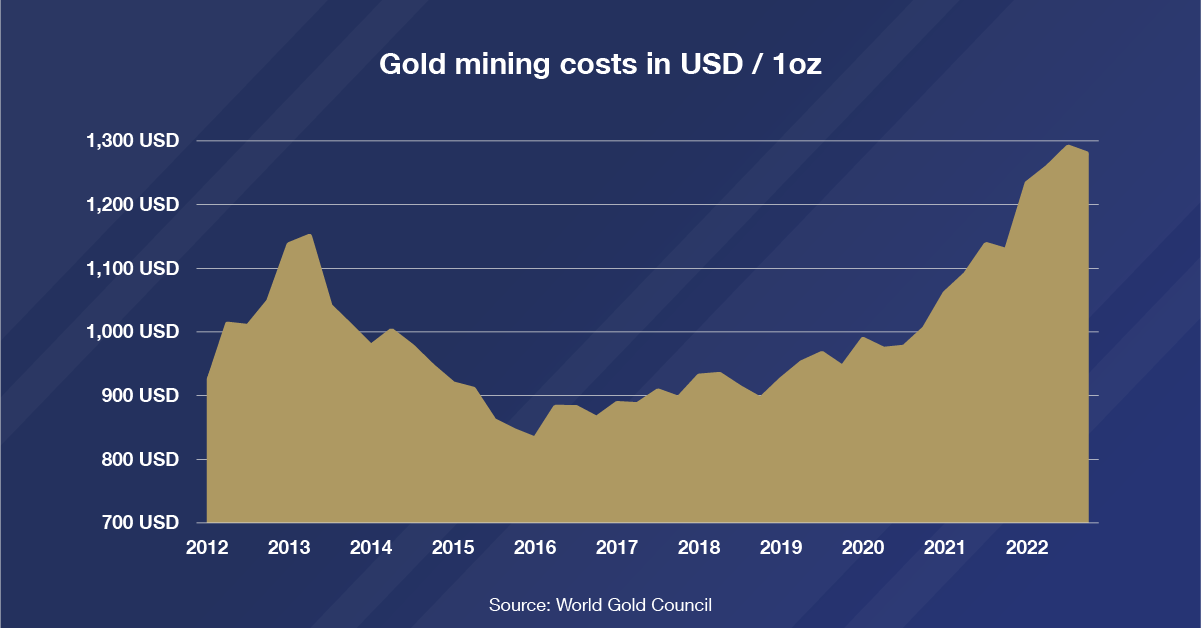

Gold mining costs have reached record levels. What is next for the metal?

03. 05. 2023Gold mining costs are rising. The total costs of mining to produce one troy ounce of gold (the average sustaining costs, which include all direct mining costs, labour, materials, energy, taxes, and royalties) rose by 18% year‑on‑year to USD 1,276 per troy ounce in 2022. They surpassed the 2012 peak mining cost level by 14%. Both the pandemic and the outbreak of war in Ukraine early last year significantly contributed to the increase.

A series of government restrictions during the pandemic disrupted global supply chains. The increased price of precious metal experienced during the coronavirus period allowed more expensive plants to begin production, but this translated into further increases in sustaining costs. When Russia invaded Ukraine early last year, these factors were exacerbated by rising energy and consumables prices. Explosives and cyanide, for example, which are crucial to gold mining, became more costly. In addition, tensions in labour markets in the major gold‑producing countries pushed up the cost of employees. Although the rise in mining costs halted in the last quarter due to lower energy and fuel prices as well as mining at higher‑grade mines, the average sustaining cost of mining of one ounce of gold for the whole year of 2022 reached a new record high of USD 1,276.

Gold demand last year almost matched the record set in 2011, which must have been reflected on the supply side necessarily. Mine production rose to a four‑year high (3,612 tonnes). According to a report by the Australian Government's Department of Industry, Science, Energy and Resources, global gold mine production is expected to grow at an average annual rate of 1.8% until 2024, peaking at 3,750 tonnes in 2025. This assumption is mainly due to the planned opening of new mines in Canada. In the coming years, production volumes will decline again. Recycling of metal also contributes to the overall gold supply. By contrast, the authors of the report forecast that this will fall by an average of 3.9% per year until the end of 2024. This will be driven by increasing demands to reduce the environmental impact of operations and consolidation in the Chinese industry.

The rising cost of mining and the limited global supply demonstrate the scarcity of gold. Record purchases by central banks and high interest from private investors and households in Germany, Asia, Africa, Russia, and Austria show that people simply believe in gold's safe‑haven power and want to use it to counter rising risks and uncertainties.